Sales distribution service insights

Strategic insights and opportunities to inform the redesign of the distribution service model.

CXCO was engaged to gather insights on the experience of our clients’ sales distribution third-party relationships, covering Mortgage brokers and Financial advisers. We utilised observational and ethnographic research to understand the service model, and communicated the current state experience on a journey map that highlighted opportunities and recommendations to improve the experience.

Our client had increased their target for customer acquisitions of their superannuation and mortgage products, and understood that they needed to be more proactive and build deeper relationships with Mortgage brokers and Financial advisers - both a key distribution channel for superannuation and mortgages.

CXCO were engaged to understand the sales distribution third-party experience, and surface strategic insights and opportunities to enable our client to support Mortgage brokers and Financial adviser and grow the distribution channel.

The opportunity

Our client’s strategic goal to become a primary bank required them to extend their market reach and increase the number of mortgage and superannuation customers. Their history as a direct-to-customer bank had limited their awareness and focus on third-party relationships as a key distribution channels, as a result they did not have a clearly defined service model for third-party relationships.

Mortgage brokers and Financial advisers currently interacted with the same digital and contact centre touchpoints as their customers. The user experience did not meet their needs and prevented them in acquiring new customers and growing their business.

Mortgage brokers and Financial advisers needed a more personal and tailored experience if they were to successfully grow their customer base. Our client needed to understand the current state experience, and surface opportunities to improve the service model.

Our approach

Discover

Discover

The kick-off workshop with the client established the business objectives, project outcomes, and project success measures. Third-party relationship managers were included in the workshop to clarify roles in the Mortgage broker and Financial adviser ecosystem, enabling us to target contextual research activities to high value relationships.

Contextual research

Contextual research

One-on-one contextual inquiries were conducted with Mortgage brokers and Financial advisers in NSW, VIC and QLD to understand their information needs, ecosystem, current experience, motivations, scenarios of use, and tasks when interacting with the financial institution. This included observing interactions with existing digital touchpoints.

Sense making

Sense making

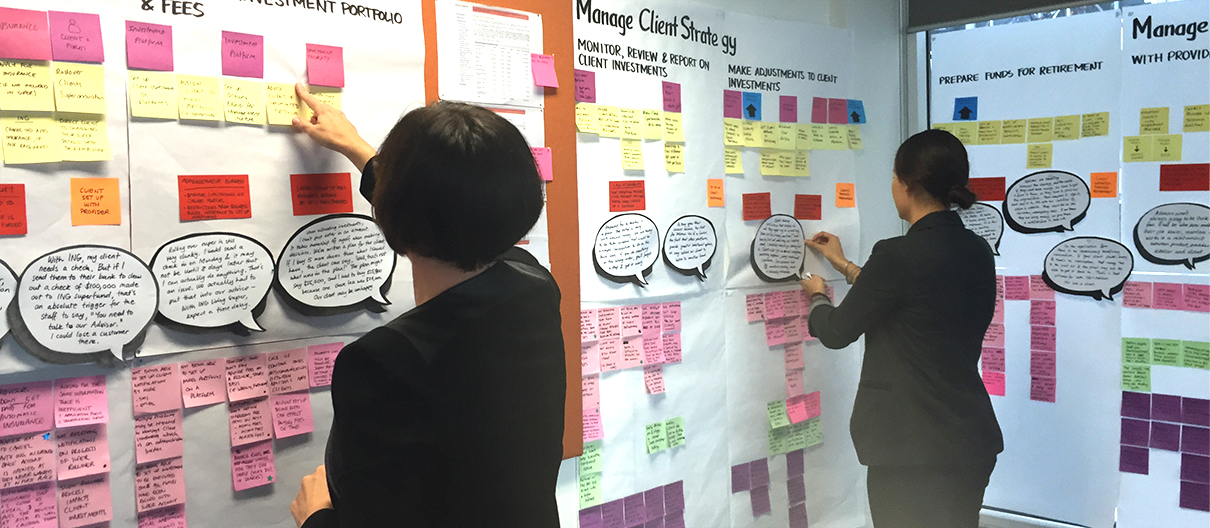

Affinity diagramming was used to analyse and synthesise over 4,000 pieces of audio and observational data, to uncover themes, patterns, and insights. This included identifying gaps and problems with the current service, and identifying required changes to internal systems and processes.

Customer journey maps

Customer journey maps

Insights were visually represented through journey maps, illustrating Mortgage brokers and Financial advisers interactions with their customers, service teams and our client. The journeys highlighted expectations, needs, pain points and points of interaction. Insights, opportunities and recommendations were delivered in a final report and presentation to stakeholders and the executive team.

CXCO produced customer journeys for Mortgage brokers and Financial Advisers as a key deliverable to the client.

Key outcomes

- Evidence based insights, opportunities and recommendations to improve the sales distribution third-party service model and experience

- A deep understanding of Mortgage broker and Financial advisor needs and expectations that informed design activities and increased understanding

- Consolidated user experience requirements for self-service features and functions to support an improved third-party experience across digital channels